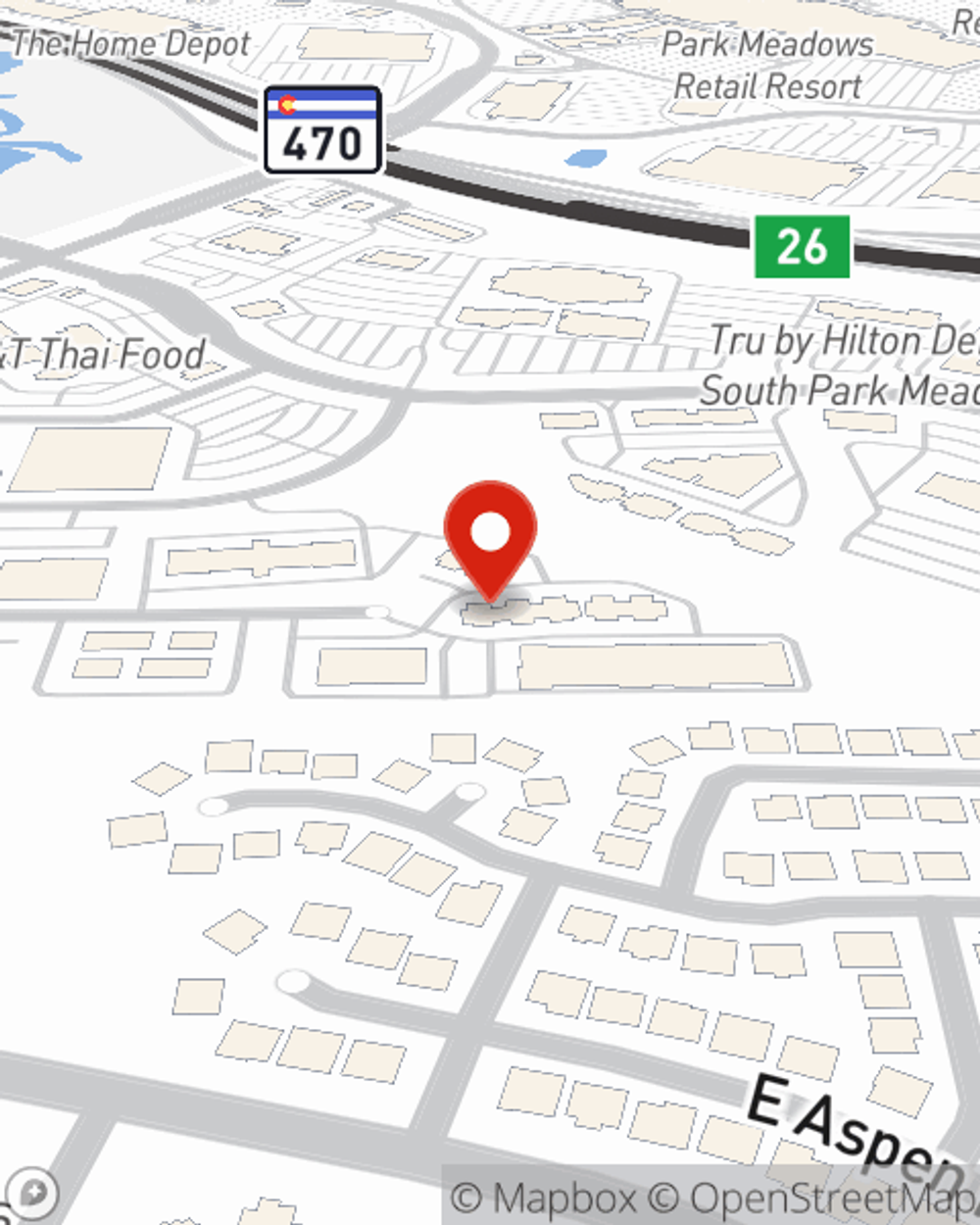

Condo Insurance in and around Lone Tree

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

- Lone Tree

- Parker

- Centennial

- Highlands Ranch

- Castle Rock

- Denver

- Aurora

- Littleton

- Castle Pines

- Greenwood Village

- Englewood

- Lakewood

- Golden

Welcome Home, Condo Owners

Things do happen.. Whether damage from weight of snow, smoke, or other causes, State Farm has reliable options to help you protect your condominium and personal property inside against unexpected circumstances.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Agent David Trudell, At Your Service

You can sleep soundly with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with dependable coverage that's right for you. State Farm agent David Trudell can help you discover all the options, from bundling, a Personal Price Plan® to possible discounts.

As one of the top providers of condo unitowners insurance, State Farm has you covered. Call or email agent David Trudell today to get started.

Have More Questions About Condo Unitowners Insurance?

Call David at (303) 773-6545 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

David Trudell

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.